Diversification is critical for managing risk and generating stable returns in an unpredictable market. This strategy involves distributing investments across different asset classes, sectors, and regions to limit exposure. While diversification itself may seem complex, it’s a foundational practice used by individual and institutional investors alike.

This article will provide the roadmap to begin diversifying your portfolio. We will overview the major asset classes to diversify among like stocks, bonds, and cash. We’ll discuss advanced diversification techniques that move beyond traditional assets. You’ll learn key strategies to build a portfolio aligned with your risk appetite and goals.

What is Investment Diversification?

The Core Concept

Diversification is an investment strategy involving distributing money across different assets and markets. The aim is to maximize returns while minimizing risk. Rather than investing in just one asset class or market sector, you spread investments over various options. This way, poor performance in one area won’t sink your whole portfolio.

At its core, diversification is about allocation – strategically dividing investments between asset classes like stocks, bonds, real estate, etc. Determining the right asset allocation depends on your risk tolerance and goals. A 30-year-old might allocate 80% to stocks for growth potential and 20% to stable bonds. A retiree may prefer a 50/50 split to lower risk. There’s no single “right” allocation, only what aligns with your needs.

Ultimately, diversification helps reduce exposure to market volatility events. Metastock tanking won’t devastate a diversified portfolio as much as an undiversified one. Diversification aims to smooth out the bumps of an unpredictable market.

A Real-World Example

Imagine putting 100% of your investments into Meta stock. This leaves you entirely exposed to the technology sector’s – and Meta’s – ups and downs. If a Meta scandal tanks their stock price, your portfolio gets decimated.

Now imagine dividing that investment – 50% in Meta, 25% in healthcare stocks, 15% in bonds, and 10% in real estate. If Meta takes a hit, you still have 75% in other assets to balance it out. Your risk is more distributed rather than concentrated all in one place.

Diversification through asset allocation doesn’t prevent all losses. But it provides more stability versus going all in on any single company or asset class. Spreading investments across different markets ensures you don’t miss out if one area underperforms.

The Multifaceted Benefits of Diversification

Boosting Returns and Reducing Risks

Diversification provides a dual benefit – growing returns while controlling risk. By spreading investments across multiple assets and markets, you increase the potential for higher gains without taking on undue risk.

For example, emerging international stock markets may offer growth potential exceeding US stocks in some years. Diversifying provides access to these opportunities. It allows participating in gains across assets and regions rather than limiting to just domestic stocks.

At the same time, diversification smooths out volatility. Different assets often perform differently in various market conditions. When stocks decline, bond values may rise. Real estate may hold steady when stocks fluctuate. Diversification ensures you don’t have all your eggs in the asset that underperforms.

Managing risk is key. Diversification aims to curb heavy losses so you stay invested during market swings. Patience pays off – diversified portfolios recover from downturns and capture upswings over the long term.

Achieving Steady Portfolio Performance

Research shows diversified portfolios generally perform in line with the overall market over decades. While diversification can’t shield you from all market volatility, it works to smooth out the ride.

Diversified portfolios better weather recessions, political events, rising interest rates, and other variables. Having assets from different sectors ensures no single event severely impacts the whole portfolio at once.

The goal is steady growth over time, not shooting for massive gains – or losses – in any single year. Diversification promotes consistency regardless of market shifts or predictive models. Keeping risk in check helps remain committed to a long-term investment strategy.

Diving Deep into Asset Classes

The Big Three: Stocks, Bonds, and Cash

When constructing a diversified portfolio, most investments will fall under these major assets:

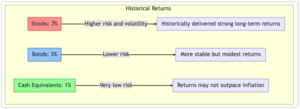

Stocks: Represent shares of ownership in a company. Offer potential for growth through rising stock prices and dividends. Higher risk and volatility but have historically delivered strong long-term returns.

Bonds: You loan money to a company or government for a set period. In exchange, they pay interest on the bonds. Lower risk with more stable but modest returns.

Cash Equivalents: Savings accounts, money market funds, CDs. Very low risk with guaranteed principal, but returns may not outpace inflation. Provides liquidity and stability.

The chart provides a visual representation of the average historical returns of three major asset classes: Stocks, Bonds, and Cash Equivalents. The returns are represented as percentages.

Allocating appropriately among these three assets is key for diversification. Stocks offer growth opportunities that bonds and cash cannot. But too high a stock allocation can mean wider swings. Balancing stocks with income from bonds and liquidity from cash builds resiliency.

Exploring Other Asset Avenues

Expanding beyond the “big three” assets can enhance diversification:

- Real Estate: Can invest directly in properties or through REITs. Adds diversification from physical assets and periodic income.

- Commodities: Gold, oil, metals – provides inflation hedge and diversification from paper assets.

- Alternative Investments: Options like private equity, hedge funds, and managed futures funds. Expand diversification into non-correlated assets.

Different assets serve different roles – growth, income, inflation protection, and stability. Combining various assets aligned with your needs is key for diversification.

Navigating the Risks with Diversification

Understanding Market vs. Asset-Specific Risks

When assessing investment risks, it’s important to understand two categories:

Market Risk – Also called systematic or undiversifiable risk. These are macro-level risks that affect the overall securities markets. Examples are recessions, wars, inflation, interest rate moves. All investments are vulnerable to market risks.

Asset-Specific Risk – Risks tied directly to an individual asset or company, like an earnings miss, lawsuit, or unfavorable regulations. Also called unsystematic or diversifiable risk.

| Market Risk | Asset-Specific Risk |

|---|---|

| Macro-level risks | Micro-level risks |

| Affects entire market | Specific to individual assets |

| Examples: Recessions, wars, inflation | Examples: Lawsuits, earnings miss, regulations |

| Cannot be diversified away | Can be minimized through diversification |

Diversification aims to minimize asset-specific risks by investing across many assets and sectors. This reduces exposure to negative events impacting only one holding or industry.

However diversification cannot completely eliminate market risk since asset values across the board decline in recessions. It works to smooth out volatility, not avoid it completely.

The takeaway? Diversification reduces single asset/sector risks but not overall market downturns. Maintaining realistic expectations of its risk-lowering powers is important.

Combining Strategies to Mitigate Risk

Diversification works best alongside other risk management strategies:

- Set aside emergency savings to avoid liquidating assets in a downturn.

- Maintain return expectations aligned with your risk appetite.

- Rebalance periodically to keep allocations on target.

- Invest long-term instead of trying to “time” volatile markets.

Diversification lays a foundation, but prudent habits are still required to grow and protect wealth over time.

Building Your Diversified Portfolio

Constructing a properly diversified portfolio may seem daunting but doesn’t have to be. Various tools and strategies make diversification accessible:

Leveraging Funds

Mutual funds and ETFs (exchange-traded funds) provide instant diversification through pooled investments. Investing in funds gives exposure to a wide variety of assets in one purchase.

| Fund Type | Description | Benefit for Diversification |

|---|---|---|

| Index Funds | Track market indexes like the S&P 500 | Diversify across index’s underlying assets |

| Target Date Funds | Auto adjust allocation over time based on set retirement date | Simplify maintaining diversification |

| Actively Managed Funds | Managers select securities trying to beat indexes | Access to professional management |

Index Funds that track market benchmarks are a popular core portfolio holding for hands-off diversification.

Target Date Funds automatically adjust their stock/bond allocation over time based on a set retirement year. This simplifies diversification.

Seeking Expert Guidance

Financial advisors and robo-advisors can create and manage diversified portfolios aligned with an investor’s goals and risk tolerance through services like:

- Strategic asset allocation

- Rebalancing to maintain targets

- Tax-loss harvesting

- Access to alternative assets

Their guidance gives confidence your portfolio aligns with long-term diversification needs.

Summary

After exploring the ins and outs of diversification, you should now feel empowered to implement this strategy. While diving into assets and allocations may seem complex at first glance, the underlying concept is straightforward – don’t put all your eggs in one basket.

Approaching investment decisions with diversification top of mind will serve you well. Consider adding exposure to:

- Different asset classes beyond just stocks

- Various market sectors, industries, and countries

- Alternative assets uncorrelated to equity markets

- Bonds to balance equity volatility

- Non-traditional diversifiers like annuities

How you choose to diversify depends on your specific situation. However, maintaining an intentional, balanced approach is wise in all market environments.

Resist the urge to constantly react to market shifts and predictive models. Remain committed to diversification through ups and downs. Patience and discipline pays off over the long run.

If feeling overwhelmed, don’t be afraid to seek guidance. Robo-advisors make diversification easy. Financial advisors can create a custom strategy. Funds offer simplicity.

While diversification alone cannot guarantee results or eliminate all risks, it remains one of the most powerful tools for reducing portfolio volatility. Paired with sound financial habits, regularly revisiting your diversification strategy will serve your long-term investment success.